Lean Portfolio Management

Lean Portfolio Management (LPM) is one of the Five Core Competencies of the Lean Enterprise. The Lean Portfolio Management competency aligns strategy and execution by applying Lean and systems thinking approaches to strategy and investment funding, Agile portfolio operations, and governance. These collaborations give the enterprise the ability to execute existing commitments reliably and better enable innovation by building on the foundation of the four other core competencies.

Introduction

A SAFe portfolio is a single instance of the Framework that manages a set of Value Streams for a specific business domain (e.g., consumer banking, commercial insurance, department of veteran affairs). Each value stream delivers a set of software and system Solutions that help the enterprise meet its business strategy, either by providing value directly to the customer or in support of internal business processes. In the small-to-midsize enterprise, one SAFe portfolio can typically govern the entire solution set. In larger enterprises—usually those with more than 500 to 1,000 technical practitioners—there can be multiple portfolios, typically one for each line of business, or structured around the organization and funding model. The Lean Portfolio Management (LPM) function governs each SAFe portfolio, providing strategy and investment funding, Agile portfolio operations, and Lean governance. The Portfolio Canvas defines and charters a SAFe portfolio. Lean budgets are further directed by a set of guardrails that are set to meet the specific needs of an individual portfolio.

Why Lean-Agile Leaders?

The reason for Lean Portfolio Management is straightforward: traditional approaches to portfolio management inhibit the flow of value and innovation in the enterprise. They were not designed for a global economy and the impact of digital disruption. This new reality puts pressure on enterprises to work with a higher degree of uncertainty yet deliver innovative solutions much faster. Despite this new reality, many legacy portfolio practices remain. Typically, these include:

- Annual planning and rigid budgeting cycles

- Measures of progress that focus on document-driven deliverables and task completion, versus objective measures of value

- Perpetual overload of demand versus capacity, which decreases throughput and belies effective strategy Phase-gate approval processes that don’t mitigate risk and discourage incremental delivery

- Project-based funding (moving people to the work) and cost accounting, which causes friction and unnecessary overhead, finger pointing, bureaucracy, and delays

- Overly detailed business cases based on highly speculative and lagging ROI projections

- Centralizing and developing requirements with people who will not be doing the actual implementation

- Iron-triangle strangulation (fixed scope, cost, and date projects), which limits agility and does not optimize the total economic value

- Traditional Supplier management and coordination, which favors win-lose contracts, and focuses on the lowest short-term cost, rather than the highest lifecycle value

Also, when portfolio management is unfamiliar with software capitalization in Agile, it often impedes the transformation to Lean-Agile approaches.

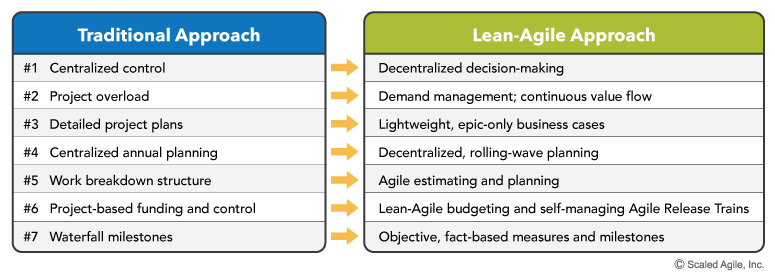

Clearly, portfolio management approaches must be modernized to support the new Lean-Agile way of working. Fortunately, many enterprises have already gone down this path, and the change patterns are fairly clear, as illustrated in Figure 1. Most of these will occur naturally in a SAFe transformation, but change is hard, indeed. Caution and awareness are warranted.

To address the challenge of defining, communicating, and aligning strategy, the LPM function in SAFe has the highest level of decision-making and financial accountability for the value streams and solutions in a SAFe portfolio.

The people who fulfill the LPM function have various titles and roles and are often distributed throughout the organization’s hierarchy. As LPM is critical to the Lean enterprise, their responsibilities must be given to business managers and executives who understand the enterprise’s financial, technical, and business contexts. They must go to the people ultimately responsible for portfolio strategy, operations, and governance, and outcomes.

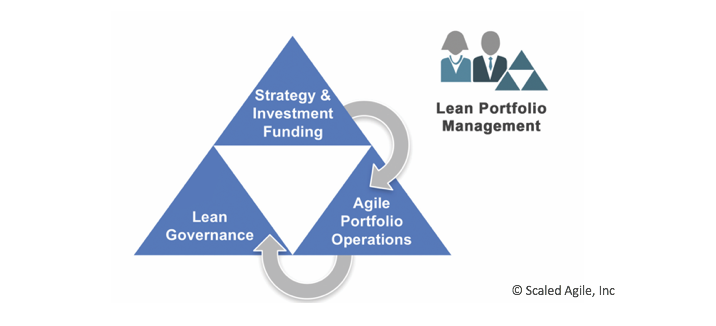

Figure 2 illustrates the three essential collaborations needed to realize the Lean Portfolio Management competency:

- Strategy and investment funding

- Agile portfolio operations

- Lean governance

-

Figure 2. Three Lean Portfolio Management Collaborations

Strategy and investment funding is perhaps the most important of the three collaborations. Only by allocating the ‘right investments’ to building the ‘right things’ can an enterprise accomplish its ultimate business objectives. Achieving these goals requires the focused and continued attention of LPM.

The strategy and investment funding collaboration engage enterprise executives, Business Owners, portfolio stakeholders, technologists, and Enterprise Architects. They discuss, debate, and ultimately agree and communicate portfolio strategy.

As Figure 3 illustrates, LPM fulfills their responsibilities for this collaboration by connecting the portfolio strategy to the enterprise strategy, maintaining a portfolio vision, funding value streams, and establishing portfolio flow.

-

Figure 1. Evolving traditional mindsets to Lean-Agile thinking

The primary responsibilities of this collaboration include coordinating value streams, supporting program execution and driving operational excellence, in part through Communities of Practice (CoPs), a Lean-Agile Center of Excellence (LACE), and other activities.

Coordinate Value Streams

Although many value streams operate independently, cooperation among a set of solutions can provide some portfolio-level capabilities and benefits that competitors can’t match. Indeed, in some cases, this is the ultimate goal: to offer a set of differentiated solutions in which new integrated capabilities may emerge to respond to expanding end-user patterns. This cooperation is described further in the Value Stream Coordination article.

Support Program Execution

Many enterprises have discovered that centralized decision-making and traditional mindsets can undermine the move to Lean-Agile practices. As a result, some enterprises have abandoned the PMO approach, distributing all the responsibilities to ARTs and Solution Trains. However, many organizations are better served by redesigning the traditional PMO to become an Agile PMO (APMO). After all, the people in the PMO have specialized skills, knowledge, and relationships with managers, executives and other key stakeholders that are extremely useful in changing ways of working.

Moreover, they know how to get things done. Working with them is far more productive than working against them. Transforming the traditional PMO to an APMO, and getting them on board to adopt SAFe, is critical.

The APMO often takes on additional responsibilities as part of the ‘sufficiently powerful coalition for change.’ In this expanded role, they usually:

- Sponsor and communicate the change vision

- Participate in the rollout (some members may even deliver training)

- Lead the move to objective milestones and Lean-Agile budgeting

- Foster more Agile contracts and leaner Supplier and Customer partnerships

The LPM function—working through the APMO and Lean-Agile Center of Excellence (LACE)—can help develop, harvest, and apply successful program execution patterns across the portfolio. In many organizations, the Release Train Engineer (RTEs) and Solution Train Engineers STEs) are part of the APMO, where they can share best practices, common program measures, and standard reporting. In other cases, they report into the development organization.

Drive Operational Excellence

LPM—or, by proxy, the APMO—also has a leadership role in helping the organization improve and achieve its business goals relentlessly. This leadership is often supported by a persistent LACE. The LACE may be a standalone group or part of the APMO that provides suggestions on how to integrate SAFe practices. The APMO may also sponsor and support Communities of Practice (CoP) for RTEs (and Solution Train Engineers), as well as Scrum Masters. These role-based CoPs provide a forum for sharing effective Agile program execution practices and other institutional knowledge.

In either case, the LACE becomes a continuous source of energy that can help power the enterprise through the necessary organizational changes. Additionally, because the evolution of becoming a Lean-Agile enterprise is an ongoing journey, not a destination, the LACE often evolves into a long-term center for continuous improvement to drive operational excellence.

The APMO can also establish and maintain the systems and reporting capabilities that ensure the smooth deployment and operation of the value stream investment:

- It acts as a communication and advisory liaison regarding strategy

- Offers key performance indicators

- Provides financial governance

It also supports management and people operations/HR in hiring and staff development. More opportunities for driving operational excellence and improvement are described in the Sustain and Improve article.

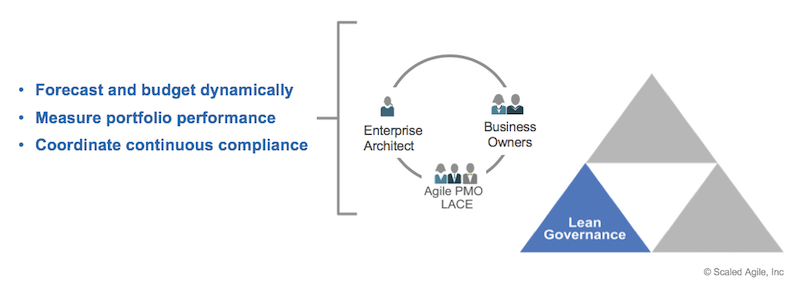

Lean Governance

In the final collaboration, Lean governance influences spending, future expense forecasts and milestones, and governance of the development effort, as illustrated in Figure 5. These stakeholders include the relevant enterprise executives, the Business Owners, the Enterprise Architects, and the APMO. Together with the ART and Solution Train, Business Owners and other stakeholders share the responsibilities described in the following sections.

Lean Portfolio Management

-

Figure 3. The strategy and investment funding collaboration and responsibilities

-

Figure 4. Agile portfolio operations colloration and responsibilities

-

Figure 5. Lean governance collaboration and responsibilities

As described earlier, SAFe provides a Lean approach to budgeting—a lightweight, more fluid, Agile process that replaces the fixed, long-range budget cycles, financial commitments, and fixed-scope expectations of a traditional planning process. It includes Agile approaches to estimating, forecasting, and longer-term roadmaps.

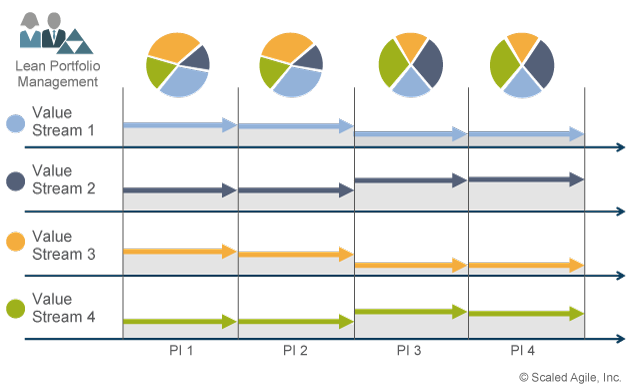

However, although value streams are primarily self-organizing and self-managing, they do not launch or fund themselves. As a result, LPM leads the tuning of the value stream budgets over time. Funding will evolve based on changing business needs, but should only be adjusted at PI boundaries, as Figure 6 illustrates.

-

Figure 6. Value stream budgets are adjusted dynamically over time

- The implementation of the strategy

- That spending aligns with the agreed-upon boundaries

- That results are continually improving

-

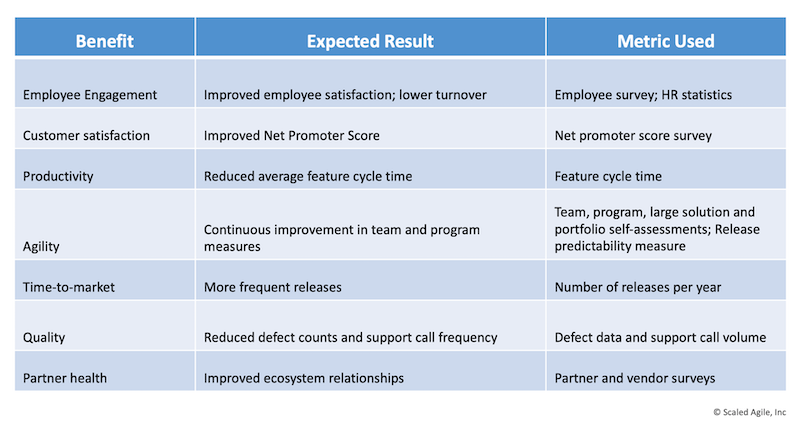

Figure 7. Lean portfolio metrics